The Anti-dilution Calculator

View how a down round affects your cap table

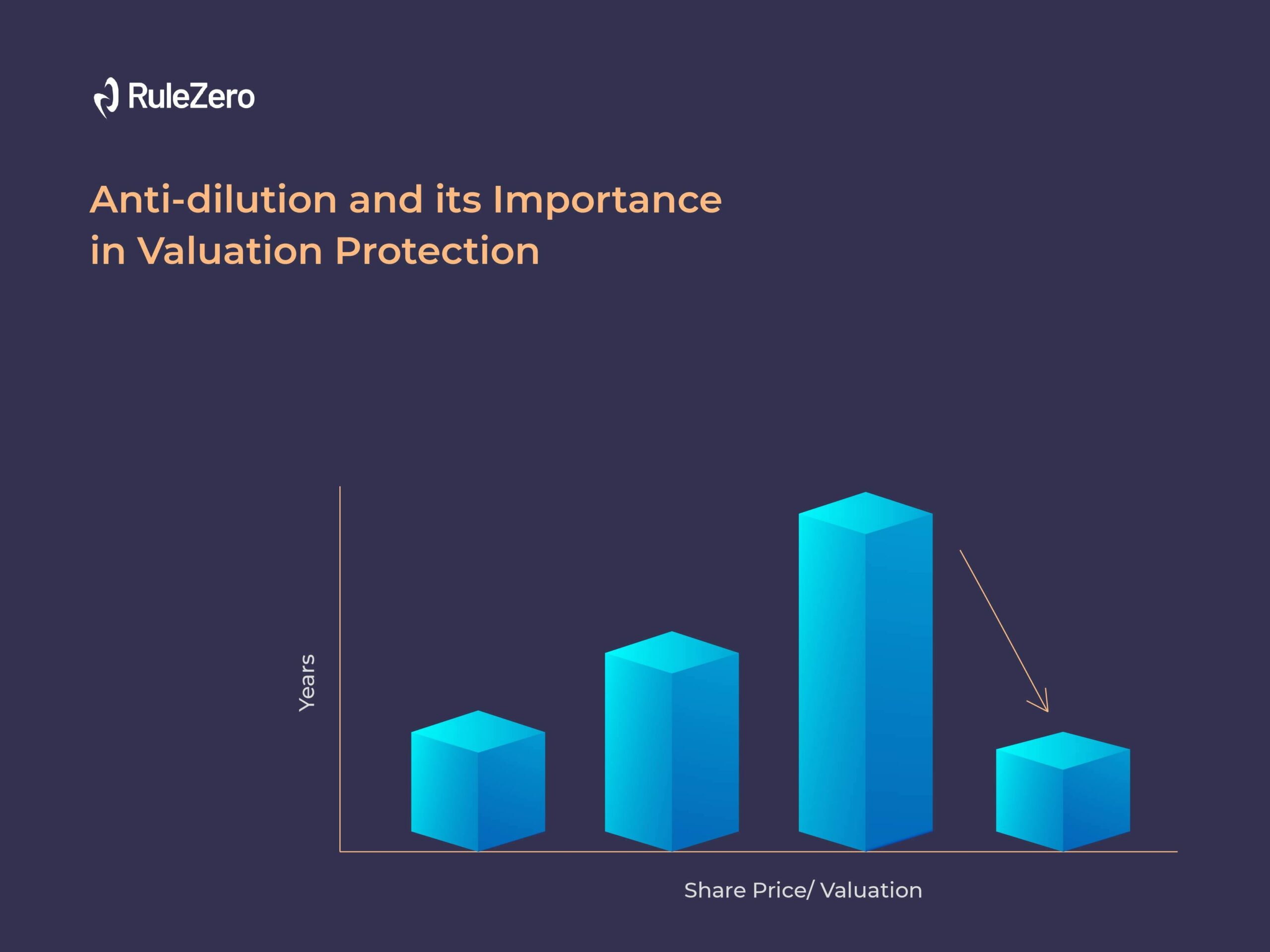

Inconsistent market and economic factors can lead to a drop in values and share prices of companies. This in turn leads to some companies having to raise new financing at values lower than what they were valued in previous rounds of financing. This is commonly called a ‘down round ’.

For obvious reasons, down rounds are not good news for existing (previous round) investors – their investments are now less valuable than they were. This is where anti-dilution protection becomes valuable. Anti-dilution clauses are standard in investment documents / shareholders’ agreements

Anti-Dilution Calculator

INR

USD

EUR

GBP

Incorporation Round

Seed Round

Series Round

Holding Percentages

No Anti-Dilution

Full Ratchet

Broad Based Weighted Average

No Anti Dilution Cap Table

| Round | Investment Amount | Current Value Of Investment | Price Per Share | Number Of Shares | Percentage Holding |

|---|---|---|---|---|---|

| Incorporation | |||||

| Seed | |||||

| Series A |

Full Ratchet Cap Table

| Round | Investment Amount | Current Value Of Investment | Anti-Dilution Additional Shares Issued | Price Per Share | Number Of Shares | Percentage Holding |

|---|---|---|---|---|---|---|

| Incorporation | ||||||

| Seed | ||||||

| Series A |

Broad Based Weighted Average Cap Table

| Round | Investment Amount | Current Value Of Investment | Anti-Dilution Additional Shares Issued | Price Per Share | Number Of Shares | Percentage Holding |

|---|---|---|---|---|---|---|

| Incorporation | ||||||

| Seed | ||||||

| Series A |